Trends and technologies for 2024.

By Xueji Zhang, Central FAE Manager, NOVOSENSE Microelectronics.

The adoption of electric vehicles (EVs) plays an important role in meeting global goals on climate change, as EVs tend to produce significantly fewer planet-warming emissions than most fuel-burning vehicles. The positive news is that consumer and commercial mobility has been transforming under the continuingelectrification of vehicles. In 2023, EV sales surged in the US, China, and Europe, helping to boost worldwide adoption to an estimated 12%.

However, there is still a long way to go for EVs to reach supremacy over the internal combustion engine. As can be expected with any technology in its early stages of development, there have been challenges hindering the widespread adoption of EVs.

Plug-in hybrid electric vehicles (PHEVs) can now compete well in larger cities with developed charging infrastructure, but pure battery-operated EVs still require further investment and innovation to become more convenient, reliable, and cost-efficient. The industry must now focus on high- voltage advancements and other emerging technological trends to integrate features more efficiently and ensure safety, all while remaining competitive on costs. In this column, we look at some of these trends and how they are likely to drive this market shift towards electrification.

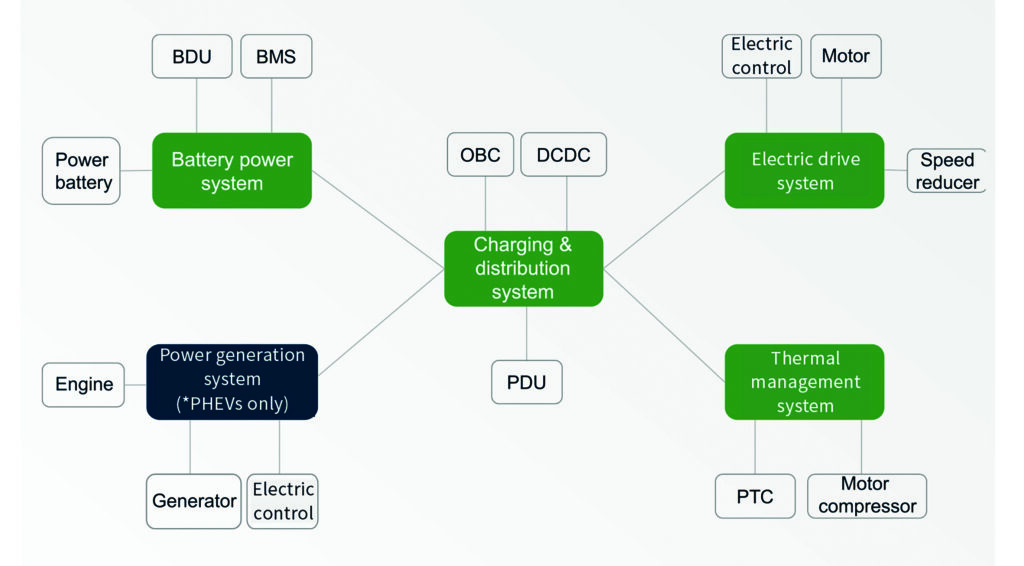

Architectural trends

Most EVs are currently run on 400V battery management systems to prevent issues like overcharging and overheating, but many EV manufacturers are nowmoving to 800V architectures. 800V platforms are regarded as the future direction for most EV manufacturers. 800V EVs enable faster and more efficient charging to ease consumer anxiety and improve user experience. 800V platforms also have lower energy consumption at high power output, especially when combined with silicon carbide (SiC) power semiconductors, meaning that mileage can be significantly improved.

In the short-term, 800V and 400V platforms will need to coexist. As the redesign and newer equipment costs tend to be higher for 800V, some manufacturers are adopting 800V only for their higher-end models and developing “booster” units for compatibility with existing charging infrastructure.

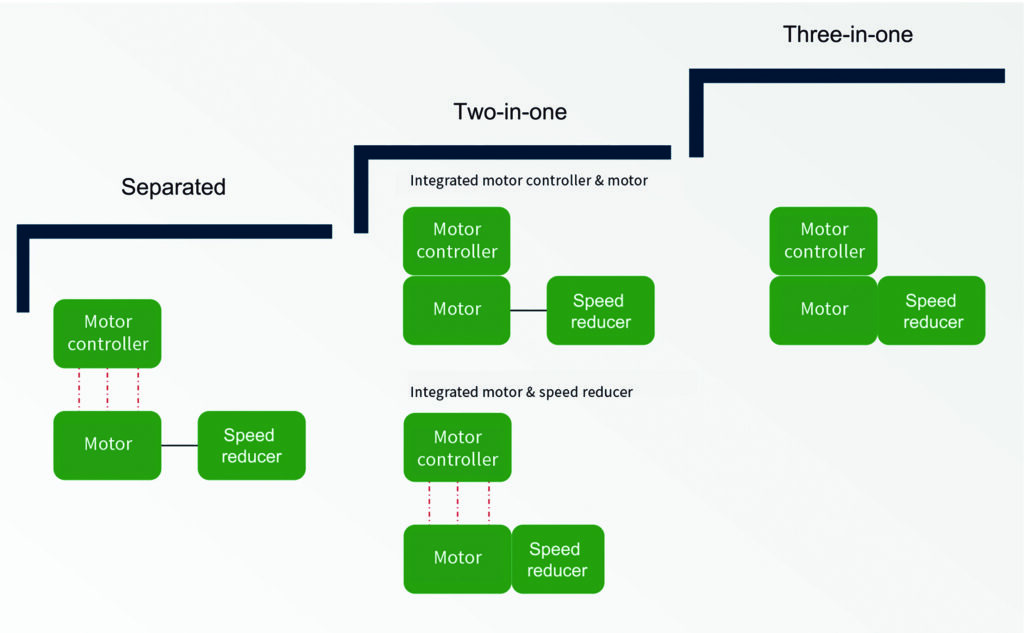

Inverter controller trends

More strategic placement of electric drive systems is another area that will offer EVs greater flexibility and integration. Their small size means they can be fitted to the drive shaft or wheel, overcoming limitations on carrying volume. Electric drive assemblies are tending toward high-level system integration, combining motors, controllers, and speed reducers to reduce weight, volume, and costs while also improving efficiency and power density. Another opportunity for development lies in the power devices within motor controllers. Upgrading the motor controllers to wide bandgap power semiconductor materials, particularly SiC, offers significant advantages. This is especially true in 800V high-voltage platforms, where energy loss can be saved in high-frequency mode and pure electric mileage can be increased.

OBC/DC-DC trends

On-board chargers (OBCs) play a crucial role in converting AC electricity to DC for battery charging, and most vehicles are equipped with them. Integration trends in power supply devices, such as combining the vehicle charger and high-voltage DC-DC components, lead to reduced material usage, achievinglightweight, miniaturisation, and cost-effectiveness.

As the EV market expands, there will be even more diversified uses for OBCs, including an external discharge function enabling two-way power flow between the vehicle and the grid. OBC power levels are increasing, with 11kW becoming common, especially in luxury long- range models. SiC technology is also gaining popularity in OBCs, offering higher efficiency and power density.

BMS trends

The Battery Management System (BMS) serves as the overall controller for power batteries. It is responsible for collecting and calculating battery data, controlling charging and discharging, and ensuring battery protection.

Most passenger vehicles use a distributed architecture, employing a motherboard BMU and slave board cell supervisory circuit (CSC) for signal sampling. The CSC and BMU now communicate wirelessly, which can improve overall battery space utilisation and reduce the difficulty of wiring harness layout.

Chip requirements for 800V EVs

The high-voltage electrical power systems in EVs pose an inherent safety risk. Isolation technology is essential to transfer the control signal between high-voltage and low-voltage units, thereby preventing dangerous currents and enhancing signal stability. Digital isolators, specifically those using magnetic andcapacitive coupling, are

widely employed in EV high-voltage applications. The NOVOSENSE NSi82xx digital isolator series applies adaptive on-off keying (OOK) technology to upgrade its transient interference immunity to over 200kV/μs for GaN, SiC, and other high-speed switch scenarios.

Controllers in electric vehicles must meet various voltage requirements for normal operation, including 1.3V, 3.3V, and 5V for MCUs, 3-5V for sensors and communication chips, and 1.8-3.3V for memory. Power management chips, particularly in high- voltage controllers, utilise LDO power modules for stability and fast load response.

Current sensors also play a key role in new energy high- voltage system controllers, providing instant feedback on current signals for monitoring system status. They are

used in a wide number of EV systems, such as the BMS, controllers, and OBCs. The NOVOSENSE NSM2019 integrated current sensor chip offers extremely low internal primary conductor resistance, providing accurate current measurement without external isolation components for AC or DC current measurement in automotive systems.

Lastly, gate drivers play an important role in high-voltage electric switching and drive by sourcing and sinking gate current into power transistors. In high-frequency power supply systems with transistors in half-bridge topologies, minimising hardware dead time is essential for efficiency. The more widespread use of SiC and GaN solutions with their higher switching frequencies also increases the need for specialized gate drivers to ensure efficient and safe operation.

System designers must stay on top of these fast-paced EV industry trends to integrate more features, realise higher efficiency, and guarantee safety readiness while keeping costs low. To access detailed information about the world’s largest and most developed EV market, download our white paper: “High-voltagecontroller chips for new energy vehicles in China” (https://bit.ly/3R1tVbn).