Semiconductor companies are spending more on R&D to the delight of their design engineering crew as they jostle for technology market leadership.

Technology companies have jacked up their budgets for research and development activities over the last several years as the competitive environment toughened and amidst further digitalization efforts by many segments of the economy. OEMs, semiconductor suppliers – both IDMs and fabless vendors – chip equipment manufacturers and other players in the global electronics market have in general raised R&D spendings by high single-digit to even higher double-digit levels since 2021 and industry observers believe this trend may continue for several more years.

All the Top OEMs and semiconductor manufacturers reviewed appear to be investing in both capital equipment and R&D for longer-term advantages. Capital expenditures have soared to ease supply shortages that cropped up in 2020 or to improve market share in response to expectations of further penetration into adjacent or new markets. While OEMs are looking to establish a beachhead in new markets, many chipmakers are responding to the swiftly changing needs of their customers and also beefing up new product development activities as competition intensified in the segment.

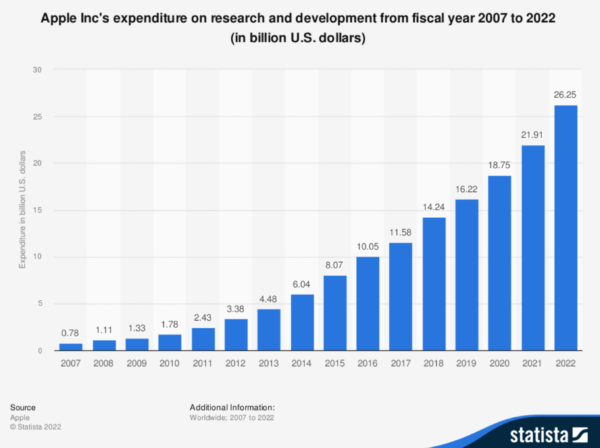

Apple Inc.’s latest financial results demonstrate the company’s determination to keep leaping ahead of the competition. The company has increased R&D at a double-digit rate over the last several years. It spent a record $27.65 billion on R&D in the 12 months ended December, up 20 percent from the prior year. On a fiscal basis, the company spent $26.3 billion on R&D, in the year ended Sept. 29, up 19.8 percent, from $21.9 billion, in fiscal 2021.

Apple has increased its R&D expenses by more than $10 billion since the end of its fiscal 2019 period. The company is expected to further raise the expenses in fiscal 2023 as it ratchets up pressure on the competition in the smartphone segment and as it explores opportunities in other markets, including in the electric vehicle segment where it is believed to be developing a vehicle.

“At Apple, creativity and collaboration have always been at the core of who we are,” said Timothy Cook, CEO of Apple, while discussing the company’s latest annual report. “That spirit of ingenuity and teamwork helped us provide our customers with incredible innovations this year and led to another yearly revenue record. In fiscal 2022, Apple achieved revenue of $394 billion, representing 8% annual growth. We set records for iPhone, Mac, wearables, home and accessories and services while growing double-digits in emerging markets and setting records in the vast majority of markets we track.”

Apple may be just getting started. The company has spent approximately $100 billion on R&D in the past 5 years but this pales beside what it has set aside for new products and innovation activities over the next decade. In 2021, Apple updated its 5-year investment plan and said it will spend $450 billion on many innovation programs. Areas of focus include “next-generation silicon development and 5G innovation” in the US and the construction of a new engineering hub in North Carolina, according to Cook.

“Apple is doubling down on our commitment to US innovation and manufacturing with a generational investment reaching communities across all 50 states,” Cook said. “We’re creating jobs in cutting-edge fields — from 5G to silicon engineering to artificial intelligence — investing in the next generation of innovative new businesses, and in all our work, building toward a greener and more equitable future.”

Spending more

Many other companies in the semiconductor segment are developing comparable long-term plans. Taiwan Semiconductor Manufacturing Co. Ltd., (TSMC), the world’s biggest contract chipmaker, has said it will spend $100 billion over a 3-year period on the construction of new fabs at its Taiwan headquarters and in various parts of the globe. The company is opening new fabs in North America and Japan while exploring similar opportunities in the European Union.

TSMC’s R&D budget is no less impressive. Starting in 2021 and through the end of 2022, it spent more than $13 billion on R&D and expects to increase the budget for 2023 by as much as 20 percent from the 2022 level of $5.5 billion, according to Wendell Huang, chief financial officer. The projected capex for 2023 will be lower, however, and is expected to be in the range of $32 billion to $36 billion, compared with $36.3 billion, in 2022. The company had initially said it would spend up to $44 billion on capex last year but trimmed this as the market swooned due to a slowdown in the larger economy.

“R&D expenses accounted for 7.2 percent of our net revenue in 2022,” Huang said, at a presentation to financial analysts. “In 2023, as we increase our focus on technology development and add more resources, we expect R&D expenses to increase by about 20 percent year on year and account for 8 percent to 8.5 percent of our net revenue.”

American chipmakers have been increasing R&D expenses for years, even raising budgets during periods of market downturns. The Semiconductor Industry Association, (SIA), said American chipmakers in 2021 spent $90.6 billion on R&D and capital equipment, helping to keep the industry’s compound annual growth rate at 5.9 percent between 2001 and 2021. The industry has always maintained a healthy investment culture even during its cyclical downturns, noted the SIA.

“To remain competitive in the semiconductor industry, firms must continually invest a significant share of revenue in both R&D and new plants and equipment,” the SIA said, in a report. The pace of technological change in the industry requires that companies develop more complex designs and process technologies, as well as introduce production machinery capable of manufacturing components with smaller feature sizes. The ability to design and produce state-of-the-art semiconductor components can only be maintained through a continual commitment to keeping pace with industry-wide investment rates of roughly 30 percent of sales.”

There are compelling reasons for why chipmakers are keeping R&D as well as capex at record levels. Innovation changes are taking place at breakneck speed across the industry and in new markets. The infusion of semiconductors into new markets and economic segments is forcing chipmakers to find ways to upgrade existing products so they can have wider applications. These efforts require higher R&D spending and the addition of new engineering skills – both hardware and software – and expansion of existing facilities.

Qualcomm Inc. has traditionally been one of the semiconductor industry’s biggest spenders on R&D. Its R&D budget flattened, however, at approximately $5 billion between 2016 and 2019 before climbing in 2019 to $6 billion and then rising in the next two years to $7.2 billion, and $8.2 billion, respectively. While rising each year in dollar amounts between 2019 and 2022, Qualcomm’s R&D expenses have started trending lower as a percentage of sales. It fell in 2021 to 21 percent of sales, from 25 percent of sales, in 2020, and dropped again in 2022, to 19 percent. The company’s revenues have almost doubled in the last four years, though, jumping to $44.2 billion, in the fiscal year ended Sept. 29, from $24.3 billion in fiscal 2019.

“The overall long-term growth opportunity for Qualcomm remains unchanged as demand for technology extends to virtually every device at the edge,” said Cristiano Amon, president and CEO of Qualcomm, while presenting fiscal 2023 first quarter results in February. “Our track record of innovation provides a unique perspective and capability to be at the forefront of the digital transformation across new and diverse end markets.”

Like its peers in the semiconductor industry, Qualcomm will have to maintain a strong R&D budget to keep its competitive edge. Companies like Micron, NXP, Nvidia, Samsung, and ST have all increased their R&D spending in recent years. Even Intel Corp., which has faced strong headwinds that clipped sales in 2022, raised rather than lower R&D expenses during the last several years. The company spent $17.5 billion (28 percent of sales) on R&D in 2022, versus $15.2 billion (19 percent of sales) in 2021.

Intel’s sales in 2022 dropped to $63 billion, down 20 percent, from $79 billion, in 2021.

Intel is spending more on R&D and capex as part of ongoing efforts to stabilize the company and catch up with market leaders in leading-edge process technology. The company lost grounds to Samsung and TSMC over the last years and has embarked upon a reorganization plan that includes the addition of new fabs and efforts to establish a strong foothold in the foundry market. For 2023, Intel declined to provide sales guidance beyond the first quarter but said it would keep operating expenses below $20 billion while investing in the key segments that would help propel future growth.

“We are very focused on the appropriate level of investment necessary for the long-term strategy of IDM 2.0 while being very thoughtful around how much capex we spend to manage our free cash flow,” said David Zinsner, chief financial officer at Intel, while presenting December quarter results. “We take a very disciplined approach to the capital allocation strategy, and we’re going to remain committed to being very prudent around how we allocate capital for the owners.”