Wide bandgap semiconductor materials like GaN and silicon carbide have emerged as the top solution to many of the power management challenges facing segments of the electronics industry.

Power electronics engineers are amongst the hottest stars of today’s OEM design world.

Thanks, in large part, to wide bandgap semiconductor materials that are finally offering innovative solutions to some of the knottiest power design and management challenges engineers have struggled to overcome over the last decades.

Of course, conventional silicon still rules the semiconductor world, accounting for the largest share of the industry’s 2021 revenue of $555.9 billion. Silicon remains King of the chip market and this is unlikely to change anytime soon.

But not in any market where a more efficient and resilient power management system is required. For automotive, aviation, medical, military, and industrial applications, electronic companies are turning to alternate materials from the wide bandgap group, especially gallium nitride, (GaN) and silicon carbide, (SiC).

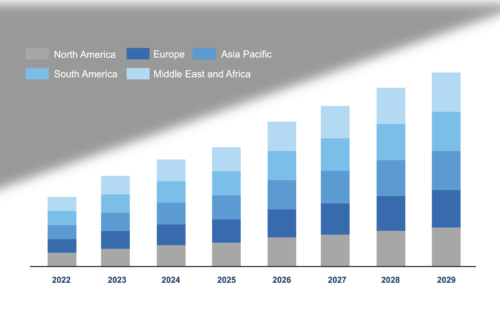

Forecasters estimate the global power semiconductor market will increase by 2030 to $50 billion, up from $40 billion, at the beginning of the decade. Driving the growth will be demand for wide bandgap semiconductor materials, which are seeing surging use in electricity generation and management as well as in storage and various market segments.

“The transmission and distribution of power across great distances are two common uses [of power semiconductors],” said analysts at Straits Research, in a report. “These high-performance components can handle several gigawatts of electrical current, voltage, and frequency. Silicon Carbide is used for high-power applications because of the wide bandgap offered. The increase in R&D activities that target enhanced material capabilities is expected to provide a strong impetus for market growth.”

As semiconductor adoption has spread across most segments of the economy, the amount of energy required to power electronic devices has exploded. The new economic opportunities need massive amounts of energy, however, while society is trying to move away from fossil fuels and exploiting non-traditional power sources such as solar, according to observers.

Design for environment

In this environment, manufacturers, governments, and communities are seeking cleaner, more efficient, and resilient power management systems. Semiconductors are key to the achievement of the long-term objectives of all the parties involved and SiC is increasingly the first option for many designers, analysts said.

“Increasing use of non-conventional energy sources such as tidal, solar and photovoltaic and growing need for more efficient power management and new safety features in the automotive industry have increased the adoption of power semiconductors in the IT & consumer electronics industry, automotive, power distribution, and rail transportation sectors,” said Allied Market Research analysts, in a recent report. “Increasing demand for compact products has enabled companies to adopt collaboration strategy to offer industry-specific products. Market players have focused on innovation in new technologies such as silicon carbide-based devices to expand their market presence.”

Factors that have pushed wide bandgap semiconductor materials to the fore of power designs have proliferated as designers try to reduce system footprint or meet stringent demands for cleaner energy systems. With demand for cleaner and more environmentally friendly energy sources climbing, pushing aside fossil fuels, the electronics industry has responded with innovative solutions based on newer and more resilient semiconductor materials, according to industry analysts.

“Power electronics play a key role in shifting electrical energy patterns to renewable energy with higher energy efficiency,” said Markets and Markets, in a report. “At present, several countries are shifting from electricity generation using fossil fuels like coal and gas to renewable energy sources and a simultaneous decline for non-renewable ones.”

The result is the emergence of a new power electronic design environment. Energy systems used in electronic devices nowadays must help OEMs achieve their desire for faster, smaller, and more efficient devices. The larger society, in turn, wants to reduce the harmful effects of global warming and has identified fossil fuels as energy sources that must be eliminated to attain this objective.

Engineers are offering wide bandgap semiconductor materials as the perfect agents for achieving objectives shared by electronic OEMs and society, according to industry executives and analysts.

“Nowadays, wide bandgap-based solutions are rapidly gaining importance,” said Infineon Technologies in a report discussing the company’s plans for the power market. “Silicon carbide and gallium nitride complement and expand the possibilities of silicon and can offer cost benefit advantages for various use cases. Several applications have reached or surpassed their tipping points, and market researchers are predicting very dynamic growth. We have a clear strategy for capturing this growth and the value associated with it.”

Silicon vs. Silicon-Carbide

The design engineering community is today actively playing up the numerous advantages wide bandgap semiconductor materials like silicon carbide has over regular silicon.

SiC is especially useful for complex devices where factors such as size, weight, stability, extreme temperature, high voltage, shock, and resistance are considered critical. Due to its resilience – hard and strong – SiC is favored for systems used in automotive, aerospace and defense, industrial and renewable energy.

It is in power consumption, though, that SiC has gained prominence over the last several years as manufacturers race to overcome production, yield and supply challenges. Manufacturers who want to reduce power consumption in SoCs, CPUs and GPUs, increasingly favor SiC and GaN nowadays.

“Companies use wide bandgap semiconductor materials to accommodate the increased power and frequencies involved in new power designs for electric vehicles, optoelectronics, and other applications that present severe operating conditions,” said Market and Market analysts. “The players operating in the power electronics industry are focusing on integrating multiple functionalities in a single chip, which results in a complex design.”

While SiC has emerged as a favored material for power devices nowadays, it is not a new discovery. In fact, it has been in use for more than one hundred years although its history in the semiconductor area is more recent. The initial use, because of its resilience, was as an abrasive.

The use of SiC in the electronics market was complicated by production and integration challenges. Companies like STMicroelectronics, Infineon and WolfSpeed have been working on SiC for many years, trying to overcome issues related to production yield and adaptability for various applications.

Many of those challenges remain today.

SiC is tough to produce but the supply chain supporting it is also not as well developed as for regular silicon. Investments in the market has also been limited to a handful of companies, although billions of dollars are now being poured into the segment to beef up production, secure raw materials and ensure adequate supply to meet surging demand.

Manufacturers have responded to the recent automotive IC shortages with plans to expand current production facilities in Europe and North America.

Semiconductor materials supplier Coherent, formerly II-VI, plans to invest about $1 billion in SiC over the next 10 years in response to rising customer demand, according to company executives.

“Our customers are accelerating their plans to intersect the anticipated tidal wave of demand for SiC power electronics in electric vehicles that we expect will come right behind the current adoption cycle in industrial, renewable energy, datacenters, and more,” said Sohail Khan, head of new Ventures & wide-bandgap electronics technologies at Coherent, in a statement announcing plans by the company to expand its factory in Easton, Pennsylvania.

In September, Infineon opened its latest power electronics fab in Villach, Austria. Construction on the fab started in 2019 and is expected to boost sales by $2 billion when operational. The fab will produce parts for OEMs serving the EV, data center, solar and wind energy markets, the company said.

Infineon followed up in November with plans to construct another 300mm power semiconductor manufacturing facility in Dresden.

Other manufacturers are making similar moves. Last year, WolfSpeed, for example, opened what it termed the world’s largest 200mm SiC fab in Marcy, New York. Company executives said the new fabs will increase the supply of SiC to customers by improving wafer quality and yield.

Later in the year, WolfSpeed said BorgWarner had agreed to invest $500 million in the chipmaker to secure supplies. The investment would guarantee BorgWarner up to $650 million in annual SiC capacity, the companies said.

“Silicon carbide-based power electronics play an increasingly important role for our customers as our electric business continues to accelerate,” said Frédéric Lissalde, president and CEO of BorgWarner, in a statement announcing the agreement. “We believe this agreement helps ensure that BorgWarner will have a reliable supply of high-quality silicon carbide devices, which are significant to the company’s inverter growth plans.”

Adds Gregg Lowe, president, and CEO of WolfSpeed: “BorgWarner has been a strong partner with WolfSpeed for many years, and we are pleased to secure the investment from them which will be used to support our capacity expansion efforts and ensure we have a steady supply of products for their customers. This agreement, combined with our most recent announcement of a multi-billion-dollar materials expansion in North Carolina, confirms the industry transition from silicon to silicon carbide is well underway.”